Greetings and welcome to our monthly newsletter.

Interest Rates

The RBA increased interest rates by 25 basis points recently which was lower that had been anticipated by the market. This in part led to a major rally in the share market with two of the best days trading of the last few years.

It is now less likely that interest rates will rise as quickly or as high as the market had anticipated. Indeed, it would be hard for the RBA to justify lifting interest rates at 50 basis points in the foreseeable future, which in turn should lead to greater investor confidence.

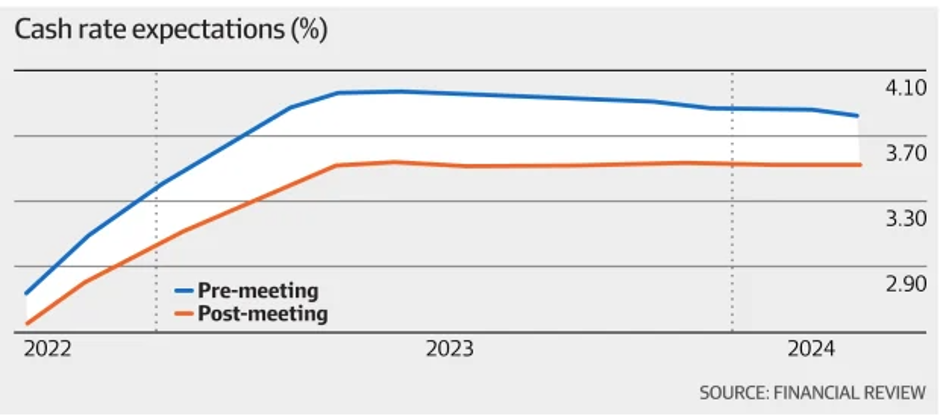

The graph below shows the projected interest rate rises over the next couple of years, adjusted for this new information, which reduces the peak by 50BP. The RBA has now lifted official Interest rates from 0.1% to 2.6% over 6 months, which is one of the quickest rises in recent history and potentially doubling the cost of retail variable mortgage rates from 2.3% to 4.8%.

The impact on consumer sentiment reflected in spending patterns will take time to assess and much of the data is a lagging indicator only reported currently quarterly in our CPI results. Having front loaded the rise in interest rates, the RBA has now indicated it will wait to see the effect of this on the wider economy before making any further rate rises in the immediate future.

Australian Equity Markets

The last two days trading has shown gains of 400 points, which equates to a 7% increase in the Australian stock market over two days and again demonstrates the extreme timing risk of being out of the market.

Momentum can and does change rapidly both for the good and bad and it remains essential to retain a long term and unemotional perspective, consistent with achieving agreed strategic financial goals.

While the main reason is the perceived peaking of interest rates domestically, a slowdown in US job vacancies has led to a similar equity rally over there, again with the expectation that interest rate rises may not be as high as previously thought.

The financial services sector rebounded particularly strongly based on the probability of improved margins add a lower likelihood of defaults from mortgage holders, with the bellwether CBA up 7% in two days, closely followed but the other major banks.

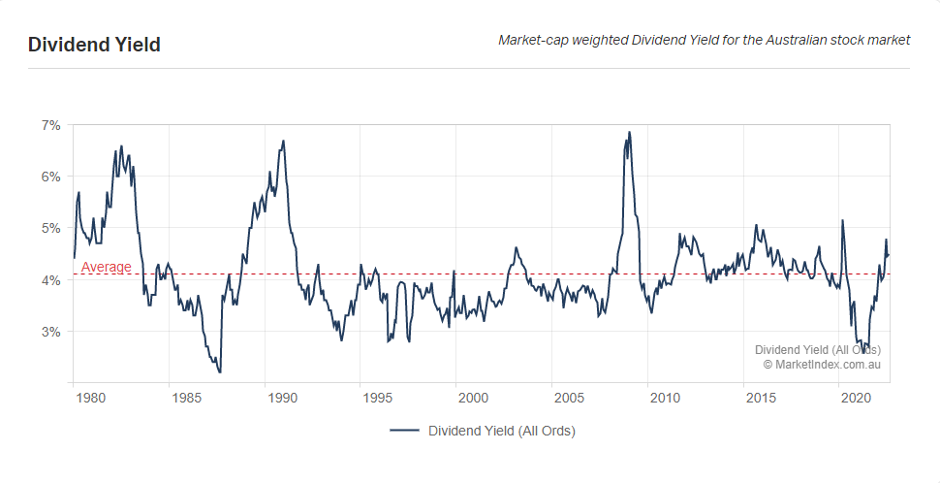

Leading growth shares such as REA lifted 12%, reflecting a more stable outlook for residential property. Future mortgage payments have become more predictable and that’s putting a floor on the recent decline in property prices. Equally importantly, significant dividends were paid out over the last few weeks from company profits, that may well now be reinvested back into the equity markets. The overall dividend yield for the ASX200 remains in excess of 5 1/2%, which looks sustainable for the immediate future and provides a solid income stream for investors, including in many cases, significant franking credits.

Dividend Yield

Source: marketindex.com.au

Overseas Equity markets

The new UK Prime Minister and Chancellor of the Exchequer shocked equity markets by introducing tax cuts and further spending at the very time the Bank of England was raising interest rates at a historical record rate.

Effectively this was like driving a car with a foot on the brake and accelerator at the same time, leading to the car skidding off the road.

Markets were brutal in their response and the Bank of England was forced to intervene in the bond market to force yields down, effectively undoing their work of lifting rates to reduce inflation. Not surprisingly the UK Government had to reverse their decision a few days later, but not before enormous damage was done to their economic credibility.

With financial markets so globally intertwined, it really is unrealistic for one country to go radically in an opposite direction and expect markets to allow an arbitrage to remain open between various jurisdictions. As has been reflected in the recent equity rally, global markets have strong correlation both positive and negative, meaning government decisions need to be taken with a view to the wider global economic market they are operating in.

Property

While residential property prices have in general declined in Sydney due to higher mortgage rates and lower borrowing power, the corollary of this has been significant increases in rent over the last 12 months.

In part this is cyclical and needs to be averaged out over a rolling five years, but the trend towards inner city living with lower transport costs and greater convenience is a feature in many global cities and expected to continue as our metro system is bedded down. With the increased immigration quotas and global travel picking up, as Covid is deemed a lower level of risk to the community, the demand for affordable housing will grow and we will need to increase the supply of available properties substantially in the next few years.

We again saw an example of bad policy reversed with the Queensland Governments ill-considered attempt to charge land tax on Australian citizens with properties in other states. This has now been reversed as it was both unconstitutional and impractical. Longer term state governments are best placed to provide an additional supply of properties and then benefit from various property taxes to support their wider spending goals.

This is another example of when poor policy ultimately fails due to not understanding the wider macroeconomic environment the state government operates in. This is however welcome news for those of you in Sydney who own property in Queensland and were concerned about additional taxation. This should be noted by the Federal Government as they prepare to deliver an interim budget later in October.

Security

The issue of data security was highlighted recently with the hacking of Optus client information. Financial Service providers are particularly targeted by these criminals and as such security measures continually are upgraded. All of our key documents to clients are fully encrypted and we have a multi-access code for all data internally which is automatically adjusted on a regular basis. All communication with clients and their respective data is securely protected and important phone calls are booked with clients well in advance. We will only ask and hold personal information required under law to complete our commercial obligations to you and full copies of all data held is available to you upon request.

At Home in Manly

It has been great to see many of you face to face again in our Manly and City offices and hopefully we can look too a more normal way of life after the difficulties of the Covid virus of the last few years. We already have the Christmas party booked and very much look forward to seeing you all face to face as we come into summer. We thank you again for your personal referrals which is the lifeblood of the business and I’m very much open for new clients who will benefit from advice. Our contact details as usual are tony.virtue@virtueandpartners.com.au and Fiona.Goodland@virtueandpartners.com.au.

With our best wishes

Tony and Fiona