Good morning to you all,

Our Election called

Our election has been called for Saturday the 3rd of May with a reminder that all voting is compulsory in Australia. This is in stark contrast to other countries such as the US which can materially impact on the election process. I think it is fair to say that this stage has been a lackluster start and that the community in general is disengaged.

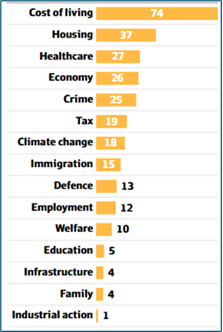

Our elections are generally determined in a very few seats and normally rely on a small amount of the population to change their voting patterns. As such expect a targeted campaign from both major parties to seek to get enough seats to form at least a minority government. The most important matter for the electorate is clearly cost of living so expect a major focus by both parties to introduce policies to reduce these costs.

Main voting issues based on polling

Source: Freshwater Strategy Poll, AFR March 30, 2025

Clearly however overseas matters in the US have now taken over much of the conversation and I will spend most of the newsletter talking about that.

Federal Budget

To some extent this was just a financial update and originally was not intended to happen. However, due to the delay in the election being called there was a mandatory requirement to update Parliament on future appropriation bills for next year 2025/2026.

As expected, there is a significant deficit for this financial year, which is budgeted to continue for the next decade, accurate budgeting is notoriously difficult and on the income side which largely relies upon corporate tax from miners to move the dial while expenses are more predictable with very significant costs relating to both Aged Care and the NDIS. There may be a small reduction in personal tax at lower rates, but this will probably be offset by bracket creep due to inflation on wages. Unlike many other jurisdictions tax brackets are not automatically indexed in Australia which pushes income into a higher tax rate for any pay increases for many clients.

Much of the policy of the current government and opposition response revolved around immediate cost of living issues and neither party seemed particularly committed to tax reform such as increase in GST or limits to the CGT exemption on the family home. From a financial planning point of view, the deeming rules will remain unchanged from 1 July 2025 and the current government’s proposal to have additional tax added to balances above $3 million in Super have now lapsed. Superannuation contributions level remains unchanged and with 39% of the population now over the age of 55 and a very strong voting cohort, the issues of providing a sustainable and stable income stream in retirement is becoming increasingly important within the community.

Here is a summary of the key aspects of the 2025-26 Federal Budget related to financial planning, courtesy of Challenger.

Trump Declaration Day

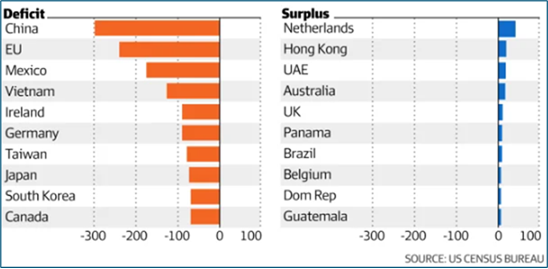

Trump declared ‘Liberation Day’ on Wednesday, April 2nd introducing a base 10% tariff on all goods from all countries into the US this was followed by an additional variable tariff per country based on the US view of the effective tariff they are paying from these countries with implementation delayed for a week to encourage some negotiation.

China received a 34% tariff and immediately responded with the same reciprocal tariff setting up a trade war. Trump is claiming the Tariffs will bring in $7 Trillion dollars over 10 years which can be used to pay down debt and provide an income tax cut for his voting base. Equity markets globally had two very rough days falling around 10% as investors factored in a higher probability of a global recession and reciprocal action from countries affected. This affects the pensions of people all around the world so you can expect pressure to reverse or at least limit these decisions over the next few days.

Tariffs by selected country

It is important to understand that this was policy by decree and has not gone through the various levels of US Government and as such it is highly likely that this will be challenged through the political process. Trump campaigned on tariffs and indeed this has been part of his manifesto for the last 40 years so to some extent this is not completely surprising.

The reality though is that countries can find new markets for their products and reduce their dependence on the US in the future, once this becomes apparent, this could be a big own goal for Trump, as not only would all imports cost a lot more for the US consumer but demand for US products would decline around the world.

Top 10 US trade balances (goods), for and against, 2024 ($USb)

The Immediate Equity Market Reaction

The initial reaction of stock markets was to fall substantially over two days in part driven by margin calls on hedge funds which exacerbated the problem. Australia is particularly vulnerable, allowing short selling on our stock market the day after the tariffs were introduced, allowing US hedge fund managers to make money in our time zone at the expense of Australian superannuants.

To be clear while short selling in normal markets is a healthy way of price discovery when markets are completely distorted by a significant market moving event it would be better for all concerned to ban short selling until market stabilised. Australia has done this in the past in the middle of the Global Financial Crisis and could again do it now if they chose to until it becomes clearer what impact the final version of Trumps tariffs will have on the Australian economy.

Trumps Tariffs bleed a record $5 Trillion in value from U.S stocks

A history of US tariffs from 1890 to current

The Tariff Act of 1890 introduced by William Mckinley a Republican raised the average duty on imports to 50% which was designed to protect domestic industries and workers from foreign competition. Interestingly soon after there was a steep increase in prices and by the 1890 election Republicans lost the majority in the House later that year losing half of their seats. The receipt of tariffs meant there was little need for income and corporation taxes at this stage to run the US government with permanent Income Tax only introduced in 1913. However, by 1893 there was a major panic and an economic depression in the United States Market declining and many banks being closed and businesses failing unemployment reaching 35%.

Markets improved post the first world war into the roaring 20’s until a major slow down leading to the great depression of 1929.

In 1930 at the height of the great depression the Smoot-Hawley Tariff Act was introduced that implemented protectionist trade policies which eccentricated the crises before being revoked and replaced with the Reciprocal Trade Agreement Act of 1934.

Over time tariffs were unwound and by the end of the Second World War the Bretton Wood agreement was signed by 44 counties committed to promoting efficient markets and collective international growth. The IMF and World Bank were established and although challenged from time to time there was a global understanding that excessive tariffs served little purpose merely increasing the global cost of goods around the world due to inefficiency.

It was better for each country to operate in areas where they had a competitive advantage and buy products from other countries at the cheapest rates possible without tariffs. While various countries certainly manipulate currency and had probably gained at the US expense, it was generally accepted that for world order and for wider political purposes that lower tariffs particularly from third world countries could continue providing it was not excessive.

In his first term President Trump had used tariffs but in a more measured fashion and they are still used particularly in Asia as we remember with China more recently in Australia with wine and seafood.

The key decision makers and their background

Trump has surrounded himself with three decision makers.

- Elon Musk (Dept of Government Efficiency)-Tesla Space X, Twitter

- Howard Lutnick (Commerce Secretary – Cantor Fitzgerald) one of the largest bond managers in the US now run by his sons – famous for being decimated in the top two towers in the 9/11 atrocity)

- Scott Bessen (Trade Secretary) -Portfolio manager for George Soros (large hedge fund)

So, each are billionaires, with their money made from the stock market and are used to living a very heavily leveraged high energy existence. They all stand to gain if the stock market does well and as such could be very fair-weather friends if the US economy looks like going into a self-induced recession. There is already talk of a winding back of these tariffs and legislation being introduced to require the senate’s approval and corporate business will put pressure on him to reverse course.

The negotiations continue

The additional tariffs apparently come into play on the 9th of April, with the intention being to allow other countries to negotiate more favourable terms for America over the next two or three days. A more likely response will be a boycotting of the US and new markets found elsewhere. The reality is this will cost US consumers substantially more money as much of the parts that they require for their products are imported particularly from Asia. This will lead to higher inflation, and it is unlikely that US manufacturing can be reestablished quickly enough to replace supply from Asia. In all likelihood, Trump will be forced to wind back these tariffs and probably blame others for this position happening in the first place. It is highly probable that there will be a wider coordinated approach from the rest of the world seeking to squeeze the US into walking this back.

Likely responses In Australia

Interest rates to fall quicker than expected, with future expected, 100% probability of a cut in May (four in all this calendar year).

This should be a positive for Australian residential property with a rotation by investors into a proven safe asset class supported by falling interest rates.

Rotation by both fund managers and financial advisers from growth shares to undervalued income paying fully franked dividends.

Larger top 20 Australian shares to bounce back first while smaller companies may struggle as may heavily exposed credit funds.

Our Approach

Keep to longer term 5-year strategies for the equity component of portfolios and accept market volatility does happen several times a year.

Hold back on new investments in equities till markets stabilise and there is a more certain outcome.

Hold distributions in cash rather than reinvesting for the next few months.

Keep adequate liquid funds to avoid being a forced seller and keep absolute liquidity in our portfolios.

Access to our advisers

As you would expect, we are working around the clock at this time and communicating quickly with clients to deal with any concerns that they have. If you do want to speak to me personally, ring the office immediately, and we will organise a formal 15-minute chat over the next day or so.

The firm has been advising now for 36 years and has been through far worse circumstances than this including the GFC and Covid and a number of global wars. This is a time to remain calm and see exposure to US shares as a rolling five-year commitment. The US stock market reached an all-time high in mid-February and is still square over a rolling 12 months.

With 39% of the Australian population now over the age of 55 and relying on stable income streams in retirement you can expect a very strong coordinated response to reverse these problems quickly. This is even more stark in the US, and I would imagine public opinion will turn very rapidly against Trump if people’s retirement balances go down and inflation goes up.

Finally, it is important to keep this in context and there have been massive improvements through technology that is really improving so much of how we live our lives. Australia remains much better place than other countries to ride out any trade wars but clearly, it’s not immune if our major trading partners such as China, Japan and Korea suffer from higher tariffs into the US.

If volatility continues to increase, I will write again shortly.

With our best wishes.

Tony and Fiona

Please note this newsletter is of a general nature only. Click to our website

ABN 42 060 673 814 • AFSL No. 407238