Good morning to you all and happy new year

Welcome to our regular newsletter where I seek to cover the main issues of the day from my own perspective and how that may impact on our investment decisions. Market conditions can change quickly, and it is a moment in time that I make these comments. We now enter our 36th year of continuous service to our community and continue to grow from strength to strength. I very much hope these thoughts are value to you and welcome your Feedback.

Trump

With his inauguration behind us is now time to try to interpret as many of his executive orders as possible and the impact this may have on investment decisions. Like many I have followed him over the years and I’m currently rereading his 1987 book, The Art of the Deal. This does give some insight into the way he thinks and importantly how he manages conflict and seeks to gain leverage over outcomes.

‘I try to learn from the past, but I plan for the future by focusing exclusively on the present’

Donald Trump 1987 The Art of the Deal

As I covered in newsletters before Christmas, there is a limit to the impact that the president makes on stock markets, which tend to be more driven by macro issues such as interest rates. However in this case there have been some asset classes that have changed quite quickly. Indeed, there is a fair bit of moral hazard here as to personal financial gain as opposed to acting in the US people’s interests. It goes without saying that there is a lot of key man risk here and if something was to happen to Trump, this could have very meaningful effects on investment decisions (such as another assassination attempt).

In the immediate it does look like this is a more business friendly administration and he has surrounded himself with several tech billionaires who presumably see him as somebody worth supporting over the next few years. It is worth noting that these highly powered people can turn very quickly, and it would not surprise if there were a few bust ups soon. Executive orders included really expanding the AI sector, which has been particularly strong for organisations such as NVIDIA over the last few years. It would seem sensible to continue to support this sector even though valuations have gone up substantially and there is a significant risk of some pullback should earnings underperform.

Trump’s Core Promises (Source: https://www.donaldjtrump.com)

At the same time the opaque investments in cryptocurrency, which are still unregulated financial products in Australia, continue to benefit from his approval including a coin in his own name which is supposedly reached astronomical values. Markets have matured to a stage where there are ETF’s over most of these currencies, which at least eliminates liquidity and ownership problems but not the volatility of the underlying investments and indeed their intrinsic wealth. For those interested we can make modest investments for you via the various administration accounts that we are running with now.

One of the key issues will be whether tariffs are imposed on other countries and if so their response, which can become a zero-sum game very quickly. It may be that Trump will just bluff away and that some resolution will be found which contributes to making America great again. In addition, the dreadful wars in Europe and in the Middle East may now be concluding as the inauguration of Trump provides a fresh start for negotiations.

For the next two years the Republicans have control of all three levels of government so you can expect Trump’s policies to pass through the political process fairly rapidly. From an Australian point of view, we run a net deficit with the US so hopefully we will be less impacted than other countries should there be an escalation in tariff wars.

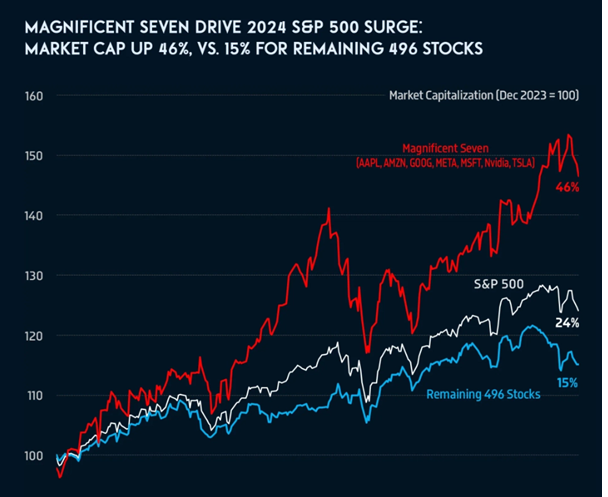

At this stage U.S. equity markets have been strong particularly the technology sector and anything to do with Elon Musk. This is partly a function of interest rates falling and the very strong market power of the large 7 technology companies, the magnificent 7, from whom nearly all the growth of the S&P 500 has come from with the other 493 really just treading water. These investments pay very low dividends so from an income point of view we still need to look towards Australia for a large part of our portfolios for those who need income from their investments to live off.

The Magnificent 7 versus the rest of the S&P 500 (Source: Veronoiapp.com, NASDAQ)

Australian Equity Markets

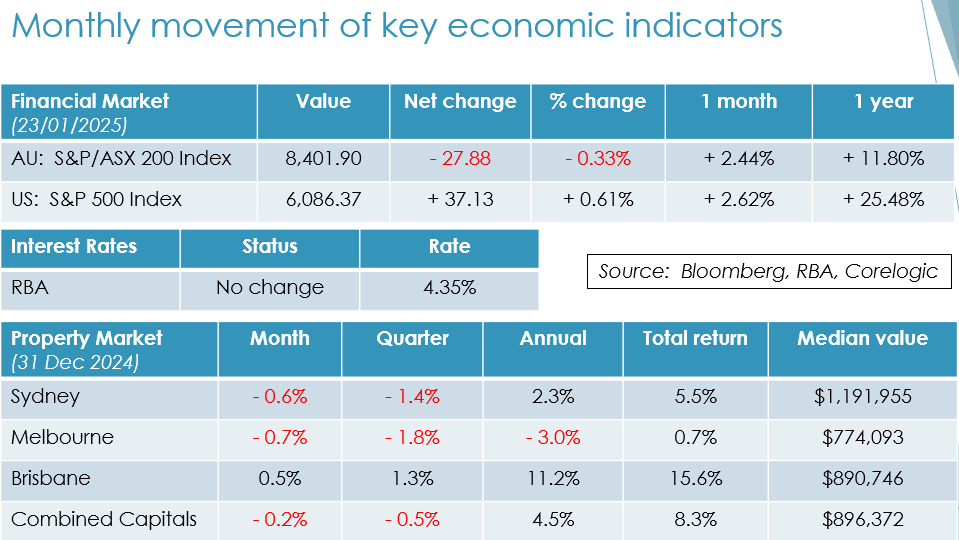

January is traditionally a quiet month for Australian equities prior to the Australia day holiday. That said there have been several takeover bids from overseas organisations, and with the expectation of interest rates dropping in either February or April, a sense of anticipation that there will be a significant number of corporate activities in the next few weeks. The interim earning season commences next week, which will give a better guide as to expected future earnings which at this stage looks quite solid.

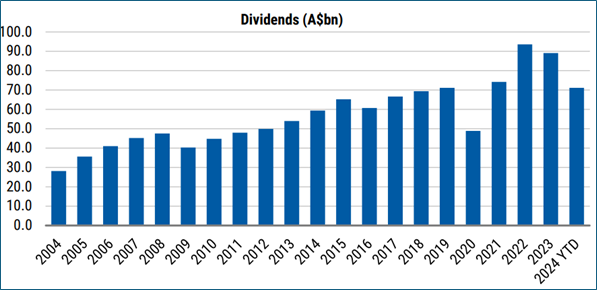

Investors are looking for good income streams from the dividends of the major banks which continue to trade strongly. Part of this is benefiting from the improvements in technology and in particular AI which is driving down the costs of providing loans and automating much of what they do. The effect of AI cannot be understated and really is impacting in a positive manner on all businesses where basic tasks are now fully automated, and staff can focus on higher value activities.

The banking and financial services sector remains the largest aspect of the ASX, which is a self-fulfilling circle from a valuation point of view very heavily linked to the stock market going up. Conversely if the market was to decline significantly this would have a multiplying effect on the underlying investments of these companies. As such we need to retain our discipline, look for solid earnings and avoid investing in speculative companies where there’s a significant moral hazard of the managers acting in their own self-interest rather than shareholders.

Total dividends paid on the ASX over the last few years (Source: Market Index, Morgan Stanley Research)

Upcoming Australian Federal Election

This is due by mid-May and from what we can see the government is effectively in caretaker mode with the option to call the election earlier in March. This does mean that a number of potential bills, including increasing tax on superannuation have been shelved and at this stage we are not anticipating any major legislative changes in this term of parliament. This will provide an opportunity for both major parties to come forward with their political platforms and for the public to have the opportunity to vote in due course. What this does mean is that there is a vacuum now which is partly being fueled by overseas interests particularly the changes taking place in the US.

Australian Residential Property

As you would expect there has been very little activity in January being the quietest month of the year with so many people being on holiday. The wider issues of undersupply remain unchanged and really it is just a case now of when interest rates do drop and by how much. At this stage there is an 80% probability in the market for February and this would be psychologically important for both homeowners and investors to see some light in the tunnel of interest rates falling.

Over the full cycle the best estimates are for a 2% fall in the RBI rates taking interest rates from 4.35% to somewhere between 2:00 and 2.5% (a 2% margin for the banks should be added to these figures). Importantly the APRA 3% buffer can be removed at any time or at least reduced to a more realistic number in a falling interest rate market. This would assist in allowing more mortgage applications to be accepted and will loosen up the market somewhat.

There was also the prospect of other states following Victoria in eliminating stamp duty for investments on new properties and replacing them with a land tax. This again would reduce the amount of capital required to purchase a property with much of the stamp duty being added to the mortgage at this stage, which is a very counterproductive way of acquiring a home. Post the federal election and the falling interest rate environment markets may well go up significantly and quickly but as always, we need to look at this as a long-term investment and there will be difficulties at some stage in the future.

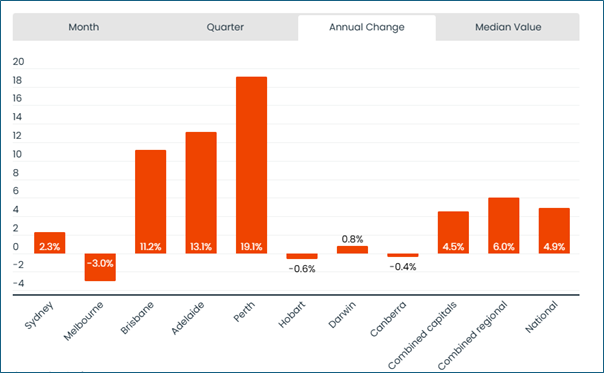

Growth in capital city property prices 12 months to 31st Dec 2024 (Source: CoreLogic)

Our news

After a decent break all team members are back at their desks and the phones are certainly ringing and emails coming in!

We are anticipating a very busy few weeks ahead following through from Trump’s inauguration which will impact on some asset class decision making. There is an increasing acceptance of using Teams or Zoom as a better way of communicating and we are constantly looking at the most efficient way of meeting your financial needs efficiently with as fewer pain points as possible.

As usual there’ll be several functions throughout the year, and we very much look forward to seeing you face to face soon

sincerely

Tony and Fiona

tony.virtue@virtueandpartners.com.au

fiona.goodland@virtueandpartners.com.au

Please note this newsletter is of a general nature only. Click to our website

ABN 42 060 673 814 • AFSL No. 407238